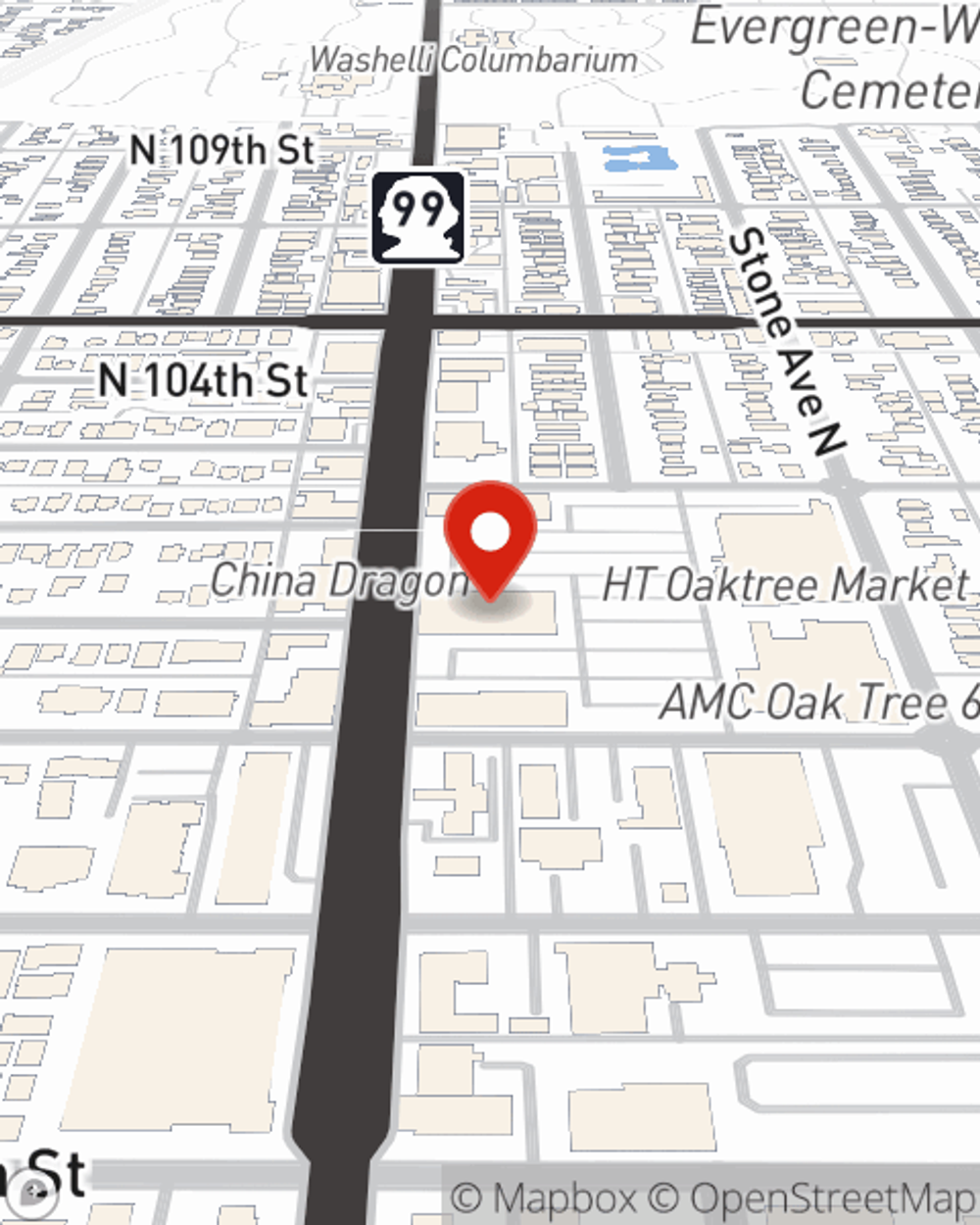

Renters Insurance in and around Seattle

Get renters insurance in Seattle

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your smartphone to your golf clubs. Overwhelmed by the many options? We have answers! Viridiana Ramos stands ready to help you consider your liabilities and help find insurance that is reliable and a good fit today.

Get renters insurance in Seattle

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

Renting a home makes the most sense for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps guard your personal possessions in case of the unexpected.

More renters choose State Farm® for their renters insurance over any other insurer. Seattle renters, are you ready to discover the benefits of a State Farm renters policy? Get in touch with State Farm Agent Viridiana Ramos today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Viridiana at (206) 876-8906 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Viridiana Ramos

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.