Homeowners Insurance in and around Seattle

Homeowners of Seattle, State Farm has you covered

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

There's truly no place like home. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, an industry leader in homeowners insurance. State Farm Agent Viridiana Ramos is your attentive authority who can offer an insurance policy aligned with your unique needs.

Homeowners of Seattle, State Farm has you covered

Help protect your home with the right insurance for you.

Agent Viridiana Ramos, At Your Service

Your home is the cornerstone for the life you hold dear. That’s why you need State Farm homeowners insurance, just in case life goes wrong. Agent Viridiana Ramos can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Viridiana Ramos, with a no-nonsense experience to get reliable coverage for your homeowner insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

It's always the right move to protect your home and valuables with State Farm. Then, you won't have to worry about the unexpected blizzard damage to your property. Contact Viridiana Ramos today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Viridiana at (206) 876-8906 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

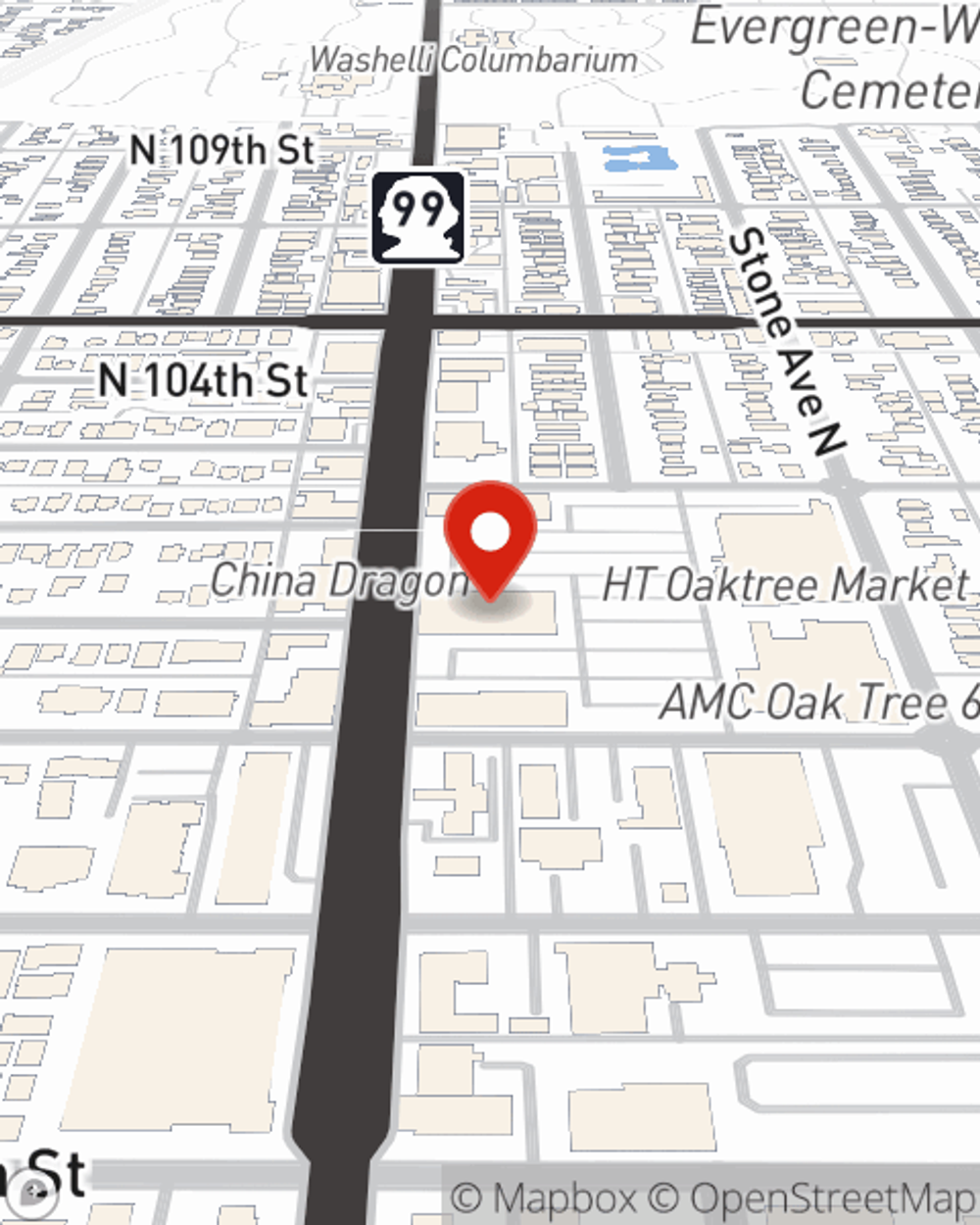

Viridiana Ramos

State Farm® Insurance AgentSimple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.